Keppel Infrastructure Trust aims to deliver sustainable returns to its unitholders, through a combination of recurring distributions and capital growth over the long term.

With ESG at the core of its strategy, the Trustee-Manager will continue to actively manage KIT’s portfolio and create value to achieve sustainable growth.

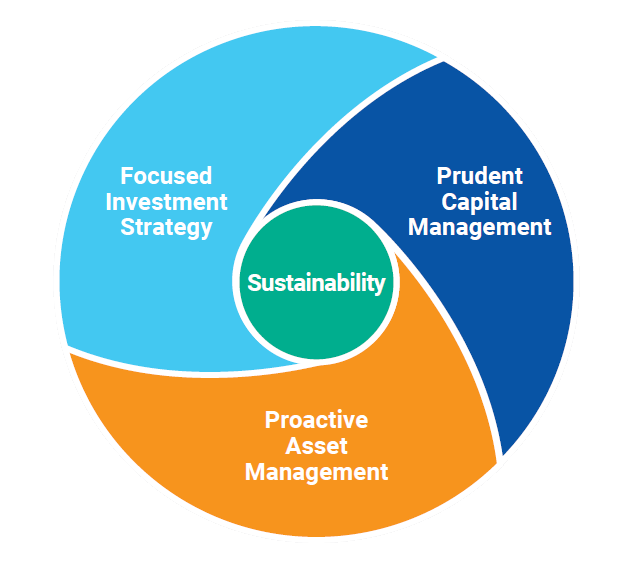

Focused Investment Strategy

- Actively pursue evergreen businesses and yield-accretive acquisitions and

investments, with a focus on developed markets globally - Pursue growth aligned with the sustainable infrastructure theme, support the energy transition, rapid urbanisation and expand into digitalisation.

Prudent Capital Management

- Employ an optimal mix of debt and equity in financing acquisitions and investments to optimise returns while maintaining financial flexibility

- Apply appropriate hedging strategies to achieve best risk-adjusted returns and enhance stability of distributions

- Diversify sources of funding

- Active risk management to ensure effectiveness of policies amid evolving market conditions

Proactive Asset Management

- Leverage technologies, digitisation and automation to enhance productivity

- Optimise portfolio through asset recycling, unlocking value for further growth

- Achieve organic growth through bolt-on acquisitions and business expansions

- Implement proactive risk management and business continuity plans

- Continue to draw on Keppel’s engineering capabilities and strong operational track record to drive asset performance

Sustainability

- Implement industry best practices to support a sustainable future

- Commitment to ESG excellence through reducing environmental impact, upholding strong corporate governance, as well as making a positive impact on the communities where KIT operates