More On Business Trusts

Business trusts were introduced in Singapore as a new form of business structure in September 2004 when the Business Trusts Act (Chapter 31A of Singapore) was passed in the Singapore Parliament.

The introduction of this new asset class – essentially companies structured as trusts – was intended to add greater depth and breadth to Singapore’s equity markets. This followed the successful introduction of real estate investment trusts (“REITS”) in 2002.

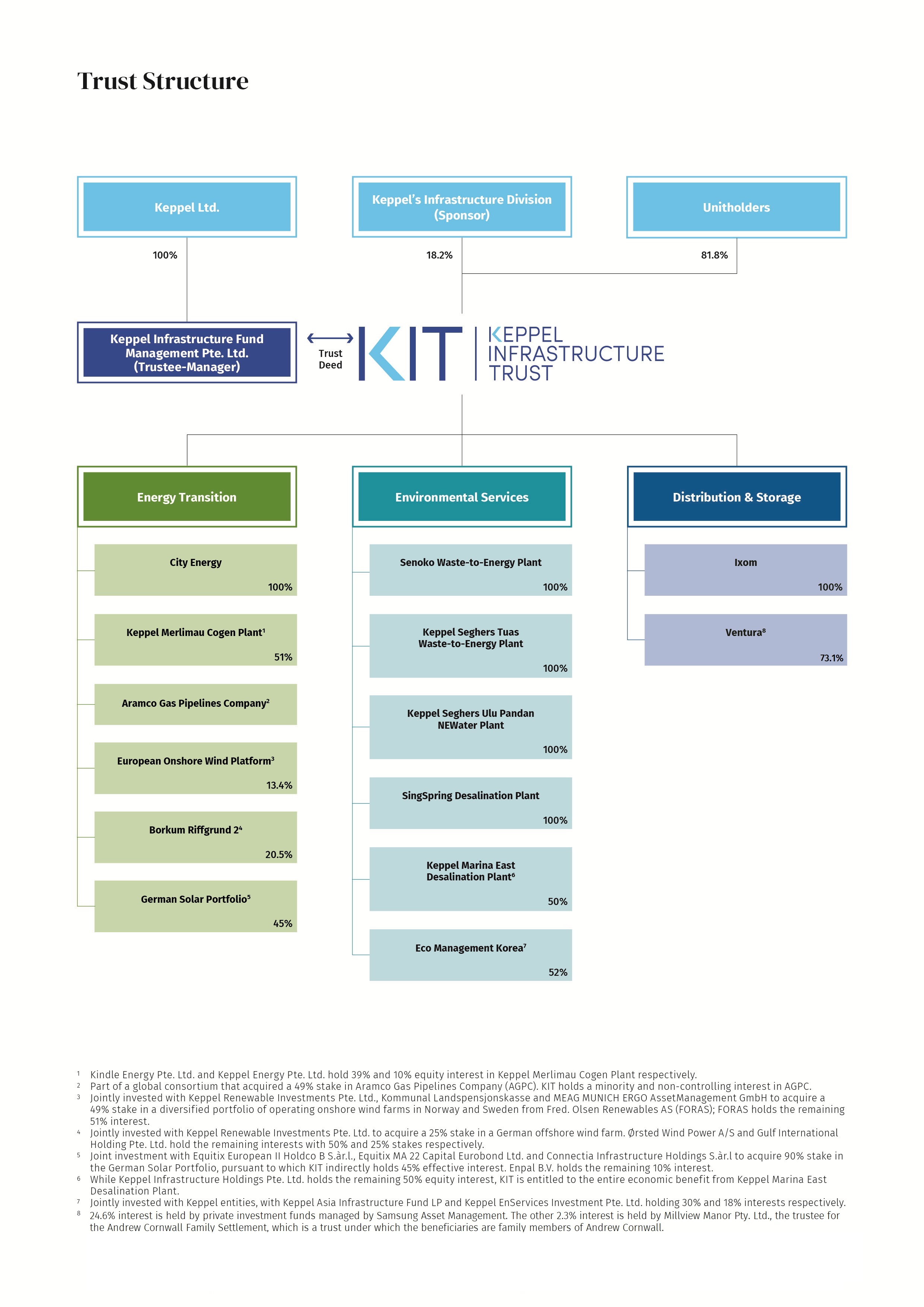

While a business trust is similar to a company in that both run and operate business enterprises, a business trust, unlike a company, is not a separate legal entity. As a business trust is established under a trust deed, the trustee-manager has legal ownership of the underlying assets in the trust. The trustee-manager is also responsible for managing the assets for the beneficial owners of the trust.

In Singapore, the Business Trusts Act has been formulated with the twin objectives of protecting the interest of unitholders (i.e. the investors) in the business trust and to establish the duties and accountability of the trustee-manager of a business trust and its directors. Business trusts that raise funds through the offering of units to the retail public must be registered under the Business Trusts Act.

The investing public of business trusts reaps benefits in the form of distributions. Business trusts are allowed to pay distributions to investors out of operating cashflow. This is unlike companies, which can only pay dividends out of accounting profits.

As such, infrastructure companies are seen to be suitable candidates for the creation of business trusts. This is due mainly to the nature of their businesses, which generally require high initial capital expenditure but which offer stable operating cashflow over the long term.

| Business Trust | REIT | Listed Company | |

| Legislation Regime |

|

|

|

| Constitution |

|

|

|

| Responsible Entity |

|

|

|

| Board of Directors |

|

|

|

| Asset |

|

|

|

| Depreciation/Revaluation |

|

|

|

| Gearing Limit |

|

|

|

| Taxation |

|

|

|

| Source: Adapted from SGX-ST website |